Inverse non-linear futures is the most common derivative instrument for cryptocurrency trading. These contracts differ considerably from the linear futures, with some of the properties appearing completely counterintuitive. This article will address these properties and how the use of leverage differs from the standard direct futures contracts.

If you’ve never heard about inverse futures, you can start with these articles:

- What is an inverse Bitcoin futures contract?

- Understanding non-linear nature of inverse futures

- Spot trading vs. inverse futures trading

- Basics of margin trading Bitcoin futures

Long positions

Long position can get liquidated even with 100% margin

As you probably know, having a long position in the linear market with 100% margin (x1 leverage) will not get you liquidated. The only time when you lose your equity is when the price goes to zero. If you bought one bitcoin, you are now in the natural long position. You didn’t borrow any funds to buy it, and you cannot get liquidated, i.e. your long position is always open and is worth something (unless the price is zero).

That is not the case with inverse futures, however. Long positions in inverse futures opened with 100% margin will get liquidated if the price goes down by 50%. At that point, the collateral posted to open the position is fully depleted. That is counterintuitive and makes no sense at first glance. If you open an unleveraged long in the linear market and the price goes 50% below, you will still have the remaining half of your equity.

To understand why it is the case, you need to remind yourself that when you are trading inverse futures pair, BTC/USD in our case, the actual underlying is the inverted USD/BTC pair. It means that you are short USD/BTC pair when you are long with inverse futures. And what happens when you are short even with 100% margin? That’s right; the losses for the short position are potentially unlimited, since the price cannot go lower than zero, but it can go, theoretically, infinitely higher.

Liquidation example

Let’s take a look at the example, and compare profit and loss formulas for the inverse and linear markets.

Suppose the current price is $10,000 BTC/USD and the contract size for the linear futures is one bitcoin. You open a long position without leverage by providing 100% margin in the capacity of $10,000. When the price goes to $5,000 BTC/USD, you have lost half of your equity, but your position stays open since you still have $5,000 left as collateral.

The formula for the long position profit and loss in the linear market:

P/L = (exit_price - entry_price) * number_of_contracts P/L = ($5,000 - $10,000) * 1 = -$5,000

The leftover margin, in this case, is $5,000.

Now, imagine you open the same long position at the same price of $10,000 BTC/USD at bitmex.com inverse futures market where each contract is worth $1.00. At the current rate, one contract price is 0.0001 BTC ($1.00 / $10,000), and a 100% margin is equal to one bitcoin.

Next, the price goes to $5,000 BTC/USD, and you calculate the profit and loss according to the inverse future P/L formula:

P/L = (1/entry_price - 1/exit_price) * number_of_contracts P/L = (1/$10,000 - 1/$5,000) * 10,000 = -1

The loss is precisely one bitcoin, meaning that the collateral posted for this long position is empty. You can confirm this for yourself with bitmex.com calculator. Note that the actual liquidation occurs a bit earlier than the bankruptcy, this is why the price below is not $5,000 precisely.

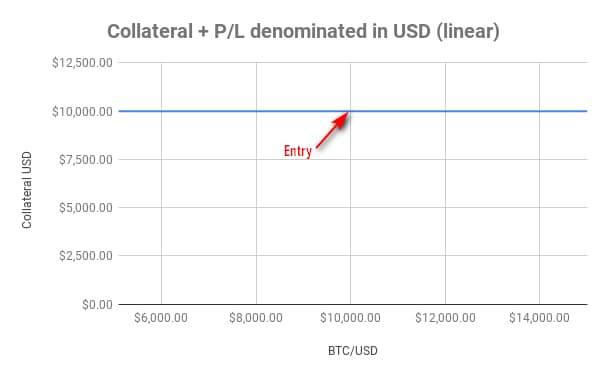

The following charts show the value of collateral from the example above in $5,000 – $15,000 price range (click the image to enlarge).

Leverage with a long position

Fundamentally, being long with x1 leverage in the inverse futures is the same as being x2 leveraged in the linear market. You can check this for yourself when you denominate your P/L and collateral in USD. The chart above shows how your USD equity looks, and you can see that it is linear while the BTC payout is non-linear. Notice that on every $100 move up, the USD value goes up by $200. That is because not only you are getting P/L from the winning position, your collateral grows in value versus USD as well. The net effect is that the payout is the same as being x2 long in the regular market. This adds up to the fact that if you’re x2 long in the linear futures, you will also get liquidated when the price moves 50% down.

Now, what will happen with the USD equity if we increase the leverage in the inverse futures, and go x2, x3, and so on? Well, the result will be the same as being long in the linear market, but with leverage higher by one level. A long position in inverse futures with x2 leverage is the same in terms of USD equity as the long position with x3 leverage in the linear market. In this case, you will get liquidated with 50% margin (x2 leverage), if the price moves 33.33% down, same as with x3 linear market long.

What if we have no position in inverse futures, but we hold bitcoin? That would mean that our leverage is x0, but our linear leverage is x1 since we’re in the natural long position just by holding bitcoins in the wallet. You can see, again, that we add +1 to the leverage in inverse futures, to see what is our real leverage in the linear market where the profit and loss are denominated in USD.

It’s impossible to gain more than 100% without leverage for longs

When you have a long position in inverse futures, with full margin, or x1 leverage, the maximum possible return on investment cannot breach 100%. For instance, if you go long one bitcoin at $10,000 BTC/USD, even if the price goes to millions of dollars, you will never double your bitcoin.

Such a property is, again, due to the fact that the real underlying pair of the inverse futures, is not the BTC/USD, but the USD/BTC. When you open a long position at $10,000 BTC/USD, you are opening a short on USD/BTC. At the current price, the $10,000 is worth one bitcoin, and with this short, we are “betting” that this sum of dollars will be worth less in terms of bitcoins in the future. Next, imagine the price goes to $100,000 BTC/USD, and the $10,000 we shorted is now worth not the whole bitcoin, but only 0.1 BTC ($10,000 / $100,000 = 0.1). The futures contract allows us to capture 0.9 BTC gain.

If the price goes infinitely higher, our profit will be approaching one bitcoin, but will never really reach it, taking the form of a decimal number 0.999999… BTC.

Let’s plug numbers from the example above into the inverse futures formula.

P/L = (1/entry_price - 1/exit_price) * number_of_contracts P/L = (1/$10,000 - 1/$100,000) * 10,000 = 0.9 BTC [exit price $100,000 BTC/USD) P/L = (1/$10,000 - 1/$1,000,000) * 10,000 = 0.99 BTC [exit price $1,000,000 BTC/USD)

As you can see, we can never double our coins unless we use the leverage. You can confirm this for yourself with bitmex.com calculator again.

Your equity in USD, however, will double, triple, quadruple and even more of course, because the collateral posted to support the position and the P/L will rise value as well. It will increase twice as fast compared to the unleveraged position in the spot market, as was explained in the previous section about leverage.

Short positions

Unleveraged short position “locks in” the USD value

Opening a short position with inverse futures without leverage, allow traders to lock in the USD value of their coins. This concept was explained in the following article: Why shorting inverse futures is perfect for hedging.

In brief, no matter where the price will go, an unleveraged short position in inverse futures always has the same USD value and will never be liquidated. You can check this with bitmex.com calculator as well. You can see that if I go short at $10,000 BTC/USD with full margin, bitcoin will have to go to two million dollars per coin to get me liquidated by the bitmex engine.

Such features make these contracts suitable for hedging purposes. If a trader, however, willing to make USD gains with a short position, he will have to use the leverage.

Let’s run some examples to get a better grasp. Suppose the price is $10,000 BTC/USD and you open a short position with 100% margin by providing one bitcoin as collateral. Next, the price goes to $12,500, and you calculated your P/L according to the inverse futures formula.

P/L = (1/exit_price - 1/entry_price) * number_of_contracts P/L = (1/$12,500 - 1/$10,000) * 10,000 = -0.2 BTC

You have lost 0.2 BTC, and the remaining collateral is 0.8 BTC then. At the price of $12,500 that collateral is worth exactly $10,000 (0.8 * 12,500 = 10,000).

Now, imagine if the price went to $7,500 BTC/USD, meaning the short position is showing some profit.

P/L = (1/$7,500 - 1/$10,000) * 10,000 = 0.33333 BTC.

The gain is 0.33333 BTC. If you add that to initial collateral of one bitcoin, that would mean that the total value of the position right now is 1.33333 BTC. That value converted to dollars at the current rate of $7,500 BTC/USD is precisely $10,000.

You can see that in both cases, the USD value of your position is $10,000. The charts below show the value of the collateral posted in the described example.

Using leverage while shorting to gain USD

As explained above, you cannot gain or lose USD without leverage when shorting inverse futures. It means that an unleveraged short position is, basically, an x0 leverage in the linear BTC/USD pair. It is the same if you held on to your $10,000 without buying bitcoin with it, it would be x0 leverage position.

When we increase the short position leverage in the inverse futures, we can start gaining USD. The x2 leverage will have the same effect on the USD equity as the x1 leverage in the linear market. On every $100 move down, your BTC collateral and P/L will be worth $100 more, and vice versa. It also means that when the price moves up by 100%, your collateral will be zero, and your position is liquidated. Same as with x1 short position in the linear market, when the price doubles and you are short.

When you further increase the leverage to x3, the USD equity of your position will be the same as if you would have been x2 short in the regular market. Every move down by $100, would increase the collateral and P/L by $200. In short, the inverse futures short position leverage should be lowered by one if you want to know what is your leverage in terms of dollars. The table below represents this relation.

As an example, below, you can see the chart of x2 leveraged position in inverse futures. Observe that we are gaining USD equity when the price moves down. That is the same payout you would expect from x1 short in the linear market.

Conclusion

The traders do not understand some of the properties of non-linear inverse futures. The underlying traded pair of the BTC/USD futures is the inverted USD/BTC pair. Such a composition of this instrument brings some counterintuitive properties. Long positions can’t gain more than 100% return denominated in bitcoins unless the leverage is used. Also, unlike in the linear market, the long positions with 100% margin will get liquidated when the price moves down by 50%. Unleveraged short positions can’t gain any USD equity unless the leverage is used. Being x1 long in the inverse futures market has the same net effect on the USD value of your position as being x2 long in the linear market. On the other hand, being x2 short in the inverse futures has the same result for the USD value of the position as being x1 short in the linear market.

Great post. Thank you

Great post, keep them coming. You menage to explain things that take me days or even months to comprehend on my own.

Great post as always. I really enjoy your posts. Would you mind writing a post about advantages and disadvantages of using hedging vs stop loss. For example if you go long futures and you hedge your position in perpetual? Would it be a good idea to enter a trade in the same time and in the same size in the opposite direction in different instruments(futures and perpetual).

Hey, thanks for feedback, I will think about it.

Great content. Any way to subscribe?

Hi, I’ll check how to implement that, thank you for the feedback.

Yes, it could be awesome!

great content. please keep on going

Excellent post. I didn’t see mention of funding, but worth pointing out that if you short without leverage in a contango market you’ll be collecting funding. So although you have no exposure on BTC movements on your notional, you do have on the funding.

Hi there, thats interesting thank you for the input. In this article I was talking about properties of a regular inverse future, not perpetual contract which uses funding. thanks for the feedback!

LONG liquidation: dP%= – (100/L+1)

Short liqudation : dP%= 100/L-1

L – leverage